people's pension higher rate tax relief

What is higher rate pension tax relief. The New York State Senate Republican Majority today unveiled the first part of their one-house budget proposal that creates a broad-based tax cut plan to provide billions of dollars in tax relief to the middle class seniors and small businesses.

How To Claim Higher Rate Tax Relief On Pension Contributions Unbiased Co Uk

If you paid a higher rate tax of 30000 you could get an additional 20 tax relief by filing a return or writing to the tax office.

. As the best tax resolution and relief company in Westchester County NY and the tri-state area our firm has specialists to stop the IRS and help troubled tax. So a 1000 pension contribution becomes 1250 in our pot. Higher-rate taxpayers who pay 40 per cent tax can currently claim back an additional 20 per cent via their self-assessment while top-rate taxpayers can claim an additional 25 per cent.

About the Company Higher Rate Tax Relief On Workplace Pensions. The plan not only eliminates this expected middle class tax increase but it also phases in a 25 percent tax rate reduction to 514 percent when fully effective. You automatically get tax relief at source on the full 15000.

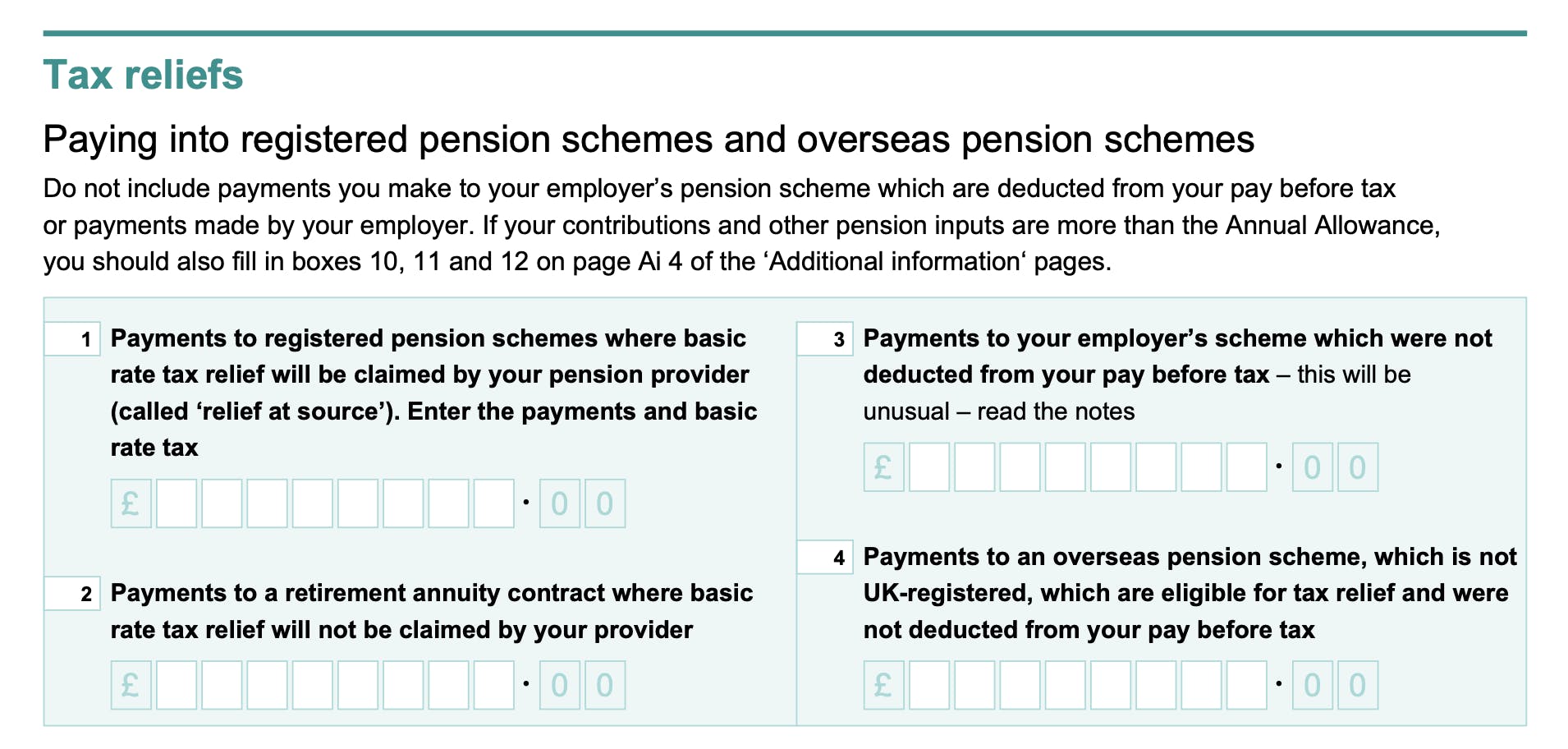

However people in group stakeholder pension schemes group personal pension schemes and personal pension schemes that they pay into privately will have to claim the 20 or 30 extra tax relief that you are owed from the government. CuraDebt is an organization that deals with debt relief in Hollywood Florida. Most of us are aware of the attractive tax benefits that come with our pension.

See reviews photos directions phone numbers and more for Tax. Hudson Valley Tax Relief. CuraDebt is a company that provides debt relief from Hollywood Florida.

On 23 March which has been dubbed tax day the Treasury will announce new consultations on proposed taxation reforms which could include reforms to pension tax. Higher-rate tax relief currently costs the government 7 billion a year with the majority of pension tax. It was founded in 2000 and has since become a participant in the American Fair Credit Council the US Chamber of Commerce and accredited with the International Association of Professional Debt Arbitrators.

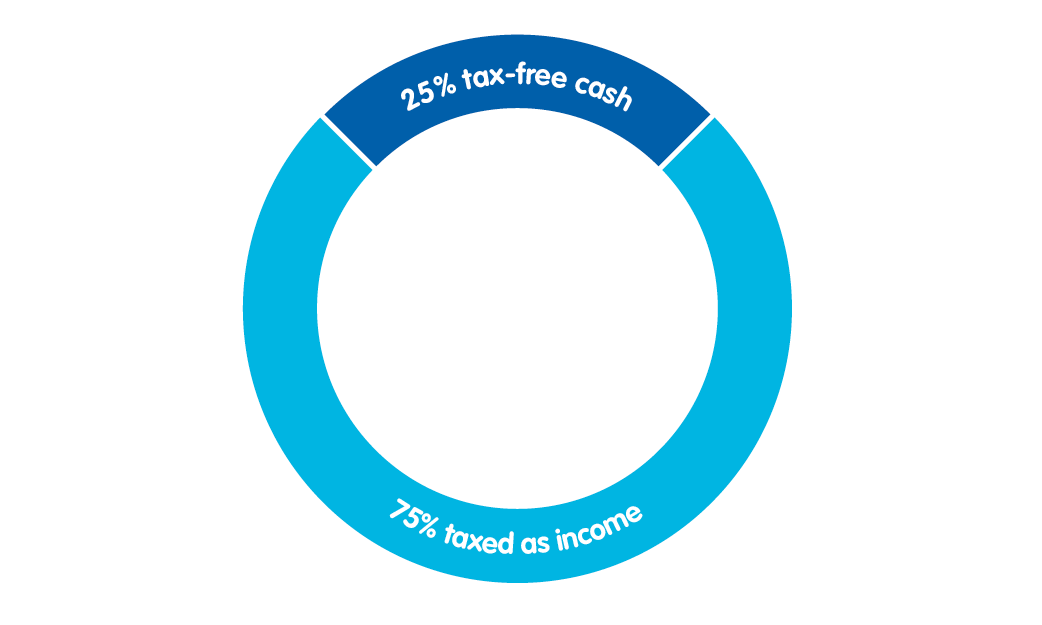

You can claim. A total of 35000 was placed in a private pension fund by you during that tax year. We all enjoy a 25 tax relief bonus every time we pay in - this comes from the basic 20 tax relief added to our pension AFTER weve already paid tax.

You put 15000 into a private pension. When people pay into their. The plan creates a new 25 percent rate reduction for middle class taxpayers new tax savings to prevent seniors from.

177 White Plains Rd. Higher rate tax relief works by increasing the thresholds upon which an investor pays basic and higher rate tax by the amount of gross personal pension contribution paid. Take an individual earning 61450 who would normally be paying 20 tax on 37700 of.

About the Company Pension Higher Rate Tax Relief. It was established in 2000 and is an active member of the American Fair Credit Council the US Chamber of Commerce and is accredited through the International Association of Professional Debt Arbitrators. The base rate tax relief of 20 is immediately applied to the full amount.

You earn 60000 in the 2022 to 2023 tax year and pay 40 tax on 10000. This is detailed in Income Tax Act 2007 part 2 chapter 3 and FA 2004 section 192 4. This permanent rate cut saves middle class taxpayers an average of 897 for a.

Your final 5000 contribution to your pension. Therefore all your pension contributions are effectively increased by 25 per cent sic automatically because every 80 turns into 100.

Pension Contributions In Ireland Pension Support Line

Higher Income Tax How To Claim Pension Tax Relief Extra 20 Boost Youtube

Pension Tax Relief On Pension Contributions Freetrade

Pension Tax Relief On Pension Contributions Freetrade

What Is Pension Tax Relief Nerdwallet Uk

How Do Pensions Work Moneybox Save And Invest

Pension Tax Relief On Pension Contributions Freetrade

Pension Tax Relief On Pension Contributions Freetrade

How Pension Tax Relief Works And How To Claim It Wealthify Com

Tax Relief On Pension Contributions For Higher Rate Taxpayers Taxassist Accountants

Don T Forget Your Pension Contributions On Your 17 18 Tax Return

Pension Tax Tax Relief Lifetime Allowance The People S Pension

.jpg)

Benefits Of Saving Through Your Pension Phoenix Wealth

Pension Tax Tax Relief Lifetime Allowance The People S Pension

Employee Tax Relief Brightpay Documentation

Pension Contributions In Ireland Pension Support Line

60 Tax Relief On Pension Contributions Royal London For Advisers

Reform Of Pension Tax Relief House Of Commons Library

How To Add Pension Contributions To Your Self Assessment Tax Return