unlevered free cash flow vs free cash flow

This is a short-cut that many investors use to quickly calculate cash flow for a company. This is the ultimate Cash Flow Guide to understand the differences between EBITDA Cash Flow from Operations CF Free Cash Flow FCF Unlevered Free Cash Flow or Free Cash Flow to Firm FCFF.

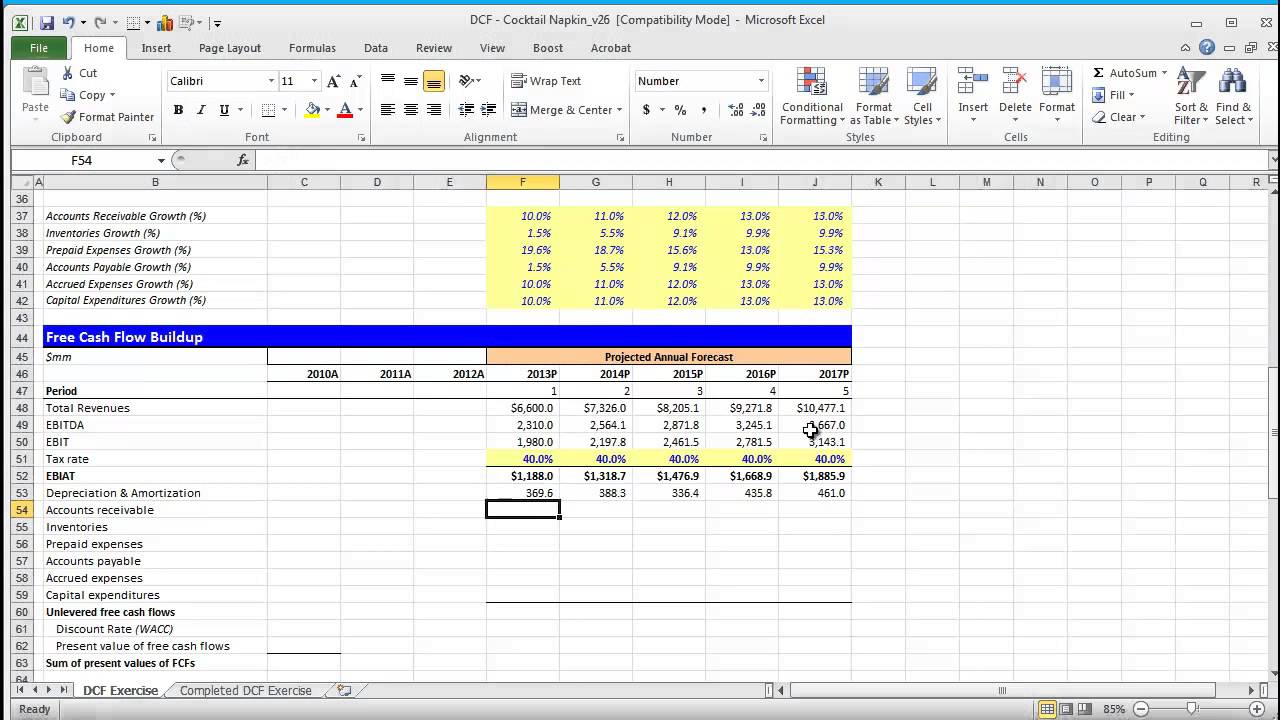

Discounted Cash Flow Dcf Valuation Model Excel Tutorials Cash Flow Excel Templates

It is the minimum return that investors expect for providing capital to the company thus setting a benchmark that a new.

. What is Unlevered Free Cash Flow. Free Cash Flow ie FCF of a company is 1145000. When performing a discounted cash flow with unlevered free cash flow - you will calculate the enterprise value.

We can help you reach your academic goals hassle-free. FCF is often referred to as unlevered free cash flow as it represents cash flow available to all providers of capital and is not affected by the capital structure of the business. FCFF is also referred to as Unlevered.

It is used to evaluate new projects of a company. Wishing for a unique insight into a subject matter for your subsequent individual. It is the ability of a company to generate cash for its capital expenditure.

There are basically two types of Free Cash Flow. Learn the formula to calculate each and derive them from an income statement balance sheet or statement of cash flows. Similar to earnings Sprint also shows a negative cash flow for 2019 so the PCF ratio is not meaningful for Sprint.

It is used in financial modeling and valuation. We have used the EBITDA Interest Expense Taxes Capex methodology for calculating free cash flow. One is FCFF and another is FCFE.

Free Cash Flow to the Firm Typically when someone is refering to free cash flow they are refering to unlevered free cash flow which is the cash flow available to all investors both debt and equity. Order Now Order Now. Read more about FCFF Unlevered Free Cash Flow Unlevered Free Cash Flow is a theoretical cash flow figure for a business assuming the company is completely debt free with no interest expense.

Weve Got Your Back. Other Free Cash Flow Formulas. Free Cash Flow to the Firm FCFF This is a measure that assumes a company has no leverage debt.

Please Use Our Service If Youre. In economics and accounting the cost of capital is the cost of a companys funds both debt and equity or from an investors point of view the required rate of return on a portfolio companys existing securities. Free cash flow FCF Cash generated by the assets of the business tangible and intangible available for distribution to all providers of capital.

Power up Your Academic Success with the Team of Professionals. 1 Free Cash to the Firm FCFF Formula. Power up Your Study Success with Experts Weve Got Your Back.

Financial Modeling Quick Lesson Building A Discounted Cash Flow Dcf Model Part 1 Financial Modeling Cash Flow Financial

Discounted Cash Flow Valuation Excel Templates Cash Flow Statement Cash Flow

Discounted Cash Flow Dcf Excel Model Template Cash Flow Cash Flow Statement Financial Charts

Discounted Cash Flow Dcf Excel Model Template Cash Flow Cash Flow Statement Financial Charts

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff In 2021 Cash Flow Statement Cash Flow Financial Statement Analysis

Discounted Cash Flow Dcf Valuation Model Cash Flow Cash Flow Statement Financial Analysis

Irr Project Finance Analysis Template Efinancialmodels Project Finance Spreadsheet Template Schedule Template